A Guide to Corporate Tax in Singapore & the Estimated Chargeable Income

Last Updated 9 September 2024

Introduction

Singapore has long held the reputation as a major business hub in Asia. Its combination of strategic location, robust economy, and business-friendly environment makes it an attractive place to set up shop.

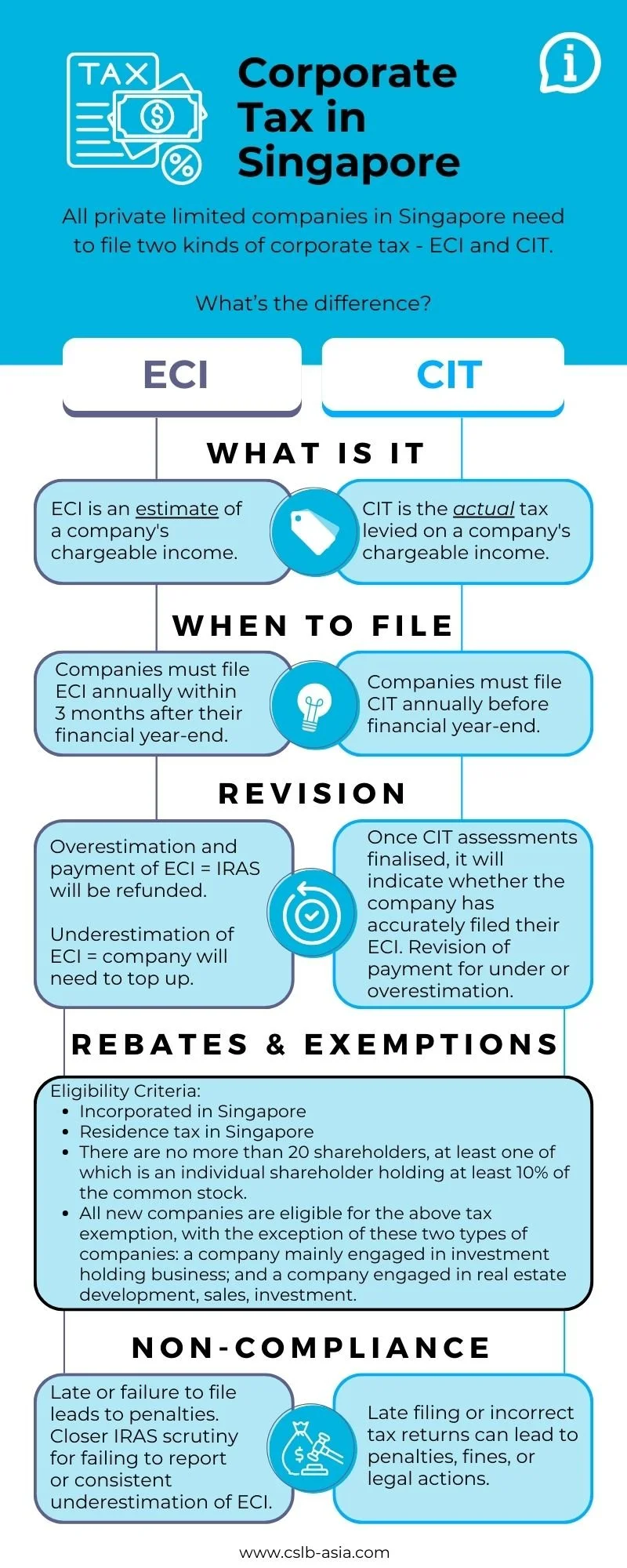

However, along with the many benefits of doing business there comes the responsibility of understanding local tax obligations. Not many businesses know that private limited companies effectively need to file their taxes twice per year, after their first year of business.

In this article, we will simplify the concept of corporate tax in Singapore, particularly the filing of the Estimated Chargeable Income (ECI), and go through what you need to know to stay on top of your corporate taxes in Singapore.

Corporate tax in Singapore: what you need to know

With a favourable flat corporate tax rate of 17%, Singapore positions itself as an attractive hub for businesses. That being said, navigating corporate tax in Singapore can be tricky. The architecture of corporate tax in Singapore mandates not one, but two tax filings - and for some businesses, a third filing involving GST returns.

Here are the 3 types of corporate tax filings you need to be aware of:

1. Estimated Chargeable Income (ECI) Filing: Every company must file an ECI within three months of the end of their financial year. This filing provides IRAS (Inland Revenue Authority of Singapore) with an estimation of the company's taxable profits after deducting tax-allowable expenses for a specific Year of Assessment (YA). Filing the ECI not only complies with tax obligations but also facilitates the possibility of paying taxes in instalments, helping companies manage their cash flows better.

2. Corporate Income Tax (CIT) Return: After the close of the company’s financial year, and once the actual financial data is available, companies must file their CIT return. Depending on your company’s financial year end date, this is typically due by November 30 each year if filing electronically, and encompasses all income, deductions, and chargeable income determined during the financial year. The CIT return finalises what a company officially owes in corporate tax, after considering what was estimated and paid through the Estimated Chargeable Income (ECI).

3. Goods and Services Tax (GST) Return: If your revenue is SG$1million and above you must register the business for GST. . These are generally filed quarterly, and businesses need to account for GST collected and paid during the quarter. This ensures compliance with GST regulations and proper accounting of the consumption tax.

Among these, the ECI and CIT are mandatory tax filings for all Singapore-registered companies. At CSLB Asia, we appreciate that our clients can be confused by the dual-filing of corporate tax in Singapore. In the next section, we’ll explain what the Estimated Chargeable Income (ECI) is for and how you can ensure that you’re adhering to this vital corporate tax requirement.

Understanding Estimated Chargeable Income (ECI)

What exactly is ECI? ECI is the Estimated Chargeable Income and it's a projection of a company's taxable income in Singapore, submitted before actual financial year data is finalised. It’s a declaration to the IRAS about what your company expects to make in terms of profit in the coming year.

The Estimated Chargeable Income is not the same as the Corporate Income Tax (CIT). Whereas CIT shows the actual taxable income that the company has received in the previous financial year, the ECI is the projected income that it will likely receive in the coming year. Think of it like a provisional tax.

When calculating the Estimated Chargeable Income, companies need to consider all their earnings, taxable benefits they may have received, and any deductions they're allowed to make. This preemptive declaration allows for a more efficient tax administration process.

If you're running a business in Singapore, you're going to have to file ECI. Most companies must do this within three months after their financial year-end (FYE). For entities concluding their financial year on 31 December, the ECI filing deadline extends to the subsequent March.

Dual filing of corporate tax in Singapore

Because of the nature of dual filing of corporate tax in Singapore, it’s easy to presume that your company needs to pay taxes twice. That’s a common misconception.

It’s true that companies have to file their taxes twice each year, which involves submitting both an Estimated Chargeable Income (ECI) and a Corporate Income Tax (CIT) return. And for both filing, your company may have to pay, but this doesn’t mean that your company is being charged twice the amount of taxes.

Companies start by filing the ECI early in the financial year. This is an early estimate of how much they expect to earn and how much tax they think they’ll owe. Filing the ECI allows companies to spread their tax payments evenly throughout the year (if you file your ECI early enough) and helps with budgeting and managing cash flow in the coming year.

Once the financial year ends and the company knows exactly how much it made, it files a CIT return. This step checks if the earlier estimates (ECI) were accurate or if adjustments are needed. If your ECI is over your CIT, the payment you’ve made to IRAS will be held and rolled over to next year’s ECI. If your ECI is below your CIT, you will be required by IRAS to pay the balance.

This system ensures that companies can manage their tax liabilities more effectively throughout the year and ensures that tax payments are closely tied to actual business performance.

The Benefits of timely Estimated Chargeable Income filing

Getting your ECI in on time has its perks. You have up to three months from when your financial year ends, and if you do it promptly, IRAS offers an instalment plan that makes it easier to handle your tax payments.

Paying taxes in smaller bites is always easier, and IRAS knows it. Here's how the instalments work if you file your ECI on time:

File within one month after your year-end: spread your tax over 10 payments.

File within two months: spread it over 8 payments.

File within three months: spread it over 6 payments.

Missed the three-month mark? Sorry, no instalment plan for you.

How do you file for your Estimated Chargeable Income?

Filing corporate tax in Singapore is seamless through the iRAS online tax portal. Simply contact us at CSLB Asia and we can assist with the filing.

Remember, the deadline for ECI filing is within three months after the end of your company’s financial year. Late filings can result in unnecessary fines and penalties. By staying proactive and following these steps, you can ensure your company meets its ECI obligations without any hassle.

Who is exempted from ECI?

All Singapore-registered companies need to file for ECI – with some notable exceptions. Here's a quick list of businesses that might not need to file ECI:

Newly incorporated companies: For their first three years of assessment, if their revenue is significantly low or nil. However, If your company is newly incorporated and has yet to commence business activities, it's often wise to file an ECI indicating a nil amount, unless falling under the exemption criteria.

Companies with annual revenue of $5 million or below: If your company's income is not taxable or is exempted from tax under any Singapore law for that assessment year, you might be off the hook for ECI filing, particularly when your annual revenue does not exceed $5 million.

Certain specific exemptions: Sometimes, IRAS might grant exemptions to certain entities due to specific reasons or under particular exemption schemes. It's always a good idea to check directly with IRAS or consult a tax professional to see if your entity qualifies under this category.

At CSLB Asia, our tax experts support our clients to file their ECI and help them ascertain whether they are exempt from filing. Book a free discovery call with our team of experts to find out how we can help you with your corporate tax filing.

Late filing and underestimating your ECI

Not filing or being late on your ECI can lead to trouble. If you just don't file it at all, here's what you're looking at:

Late filing fees: If you miss the deadline, there could be extra fees to pay for being late.

Forced estimation: The IRAS will make an educated guess about how much income your company made and tell you how much tax to pay based on that guess - which might be higher than what you actually owe. If that happens, you've got one month to pay the full amount of tax they've decided on.

Legal and reputational trouble: Keep ignoring your ECI, and in the worst-case scenario, it could even lead to legal issues as well as damage your company’s reputation and standing.

If you estimate too low on your ECI, you might pay less tax upfront, but you will still be required to pay the difference later. However, if you make it a habit of repeatedly underestimating your ECI year after year, the IRAS will flag your company and here’s what might happen:

Closer scrutiny: The IRAS might start looking more closely at your filings, requiring you to submit evidence to justify the variance.

Penalties: In some cases, they might even ask you to pay a fine for not getting your estimates right repeatedly.

Conclusion

The dual filing of corporate tax in Singapore, involving the submission of Estimated Chargeable Income and final tax returns, might seem like a hassle but it's designed to benefit businesses. Through instalment tax plans and the forward-looking approach of the ECI, companies are encouraged to plan ahead and manage their finances better.

This system not only helps businesses maintain steady cash flow but also aligns with Singapore's strict compliance and transparency standards, bolstering the country's reputation as a reliable business environment. While it may require extra effort, the process equips companies to avoid financial issues and penalties, fostering long-term stability and growth.

Last Updated 9 September 2024